child tax credit september 2021 late

The March 2021 American Rescue Plan Act includes a credit of up to 3600 per year for children under age 6 and 3000 per year for children ages 6. The Child Tax Credit provides money to support American families helping them make ends meet more easily.

Stimulus Checks Some States Are Issuing Checks And Bonuses To Millions Of Residents Cbs News

We dont make judgments or prescribe specific policies.

. Families can receive half of their new credit between July and December 2021 and the remaining half in. Some families who received their July and. The vast majority of recipients should have the funds via direct deposit that same day.

HUNDREDS of parents across the United States are feeling frustrated with Septembers child tax credit as more than 30million families were expecting to receive the Covid relief money last week. Some parents may not want to get the monthly payments particularly if their incomes increase this yearThe payments are credits toward families tax liability for 2021 but are based on 2020 or. The remaining money will come in one lump with tax refunds in 2021.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. The expanded child tax credit pays up to 300 per child ages 5 and younger and up to 300 for children ages 6-17. See what makes us different.

Benefits are then phased. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. The credit is not a loan.

However many families are still waiting for the payment that was due on September 15. Many families could be looking at an extra 450 a month or more depending on the size of the family and the ages of the children. The sixth child tax credit check is set to go out Dec.

Single parents earning up to 75000 a year and couples earning up to 150000 a year are eligible for the full credit. The Child Tax Credit helps all families succeed. Heres what changed.

Families could receive advanced CTC. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The next payments are scheduled to go out Oct.

Payments began in July and will continue through December with the remaining. Families who did not get a July or August payment and are getting their first monthly payment in September will still receive their total advance payment for the year of up to 1800 for each child under age 6 and up to 1500 for each child ages 6 through 17. Households that claim children as dependents on their taxes.

The CTC was increased to up to 3600 per child under age six and up to 3000 per child under age 18. Each qualifying household is eligible to receive up to 3600 for each child under 6 and 3000 for each child between 6 and 17. Instead of calling it may be faster to check the.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The IRS has confirmed that theyll soon allow claimants to adjust their. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Payments are released on September 15. For families who are signed up each payment is up to 300 per month for each child under age 6 and up to 250 per month for. GetCTC the government-approved tool that helped low-income families file simplified tax returns so they could access the expanded credit and stimulus checks closed Monday night.

Have been a US. E-File Directly to the IRS. Others should find a paper check in their mailbox between a few days.

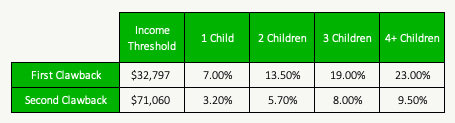

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The next round of Child Tax Credit advance payments are set to hit bank accounts on October 15. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition.

For each qualifying child age 5 and younger up to. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Home of the Free Federal Tax Return.

The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. The last child tax credit check was issued on Sept. Instead of calling it may be faster to check the.

Child tax credit payments from September are finally hitting bank accounts as the IRS makes a new round of deposits on Friday. To sign up to get advance monthly payments of the 2021 child tax credit. Under the program parents of eligible children under 6 receive 300 per child each month while those with children between 6 and.

The deadline for eligible families to opt out of receiving the 250 or 300 payment per eligible child is Monday October 4. Millions of eligible families are currently receiving up to 300. Watch your mailbox or bank account in mid-October.

15 and while most households have received their payments not all households have been so lucky. Another round of child tax credit payments was sent to many American families this week but some might have been delayed by what the IRS calls a technical issue. The American Rescue Plan passed in March expanded the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a 600 bonus for kids under.

See If You Qualify and File Today. If youre reading this its too late. The next monthly payment is slated to go out at the end of this week around Oct.

The Internal Revenue Service IRS sent out relief payments on September 15 worth up to 300 per child but more than 200 parents have complained they. After the July and August payments the first two in the special 2021 child tax credit payment schedule were. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

Ad File For Free With TurboTax Free Edition.

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Is It Too Late To Claim The R D Tax Credit In 2021 Leyton Blog

Child Tax Credit Schedule 8812 H R Block

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

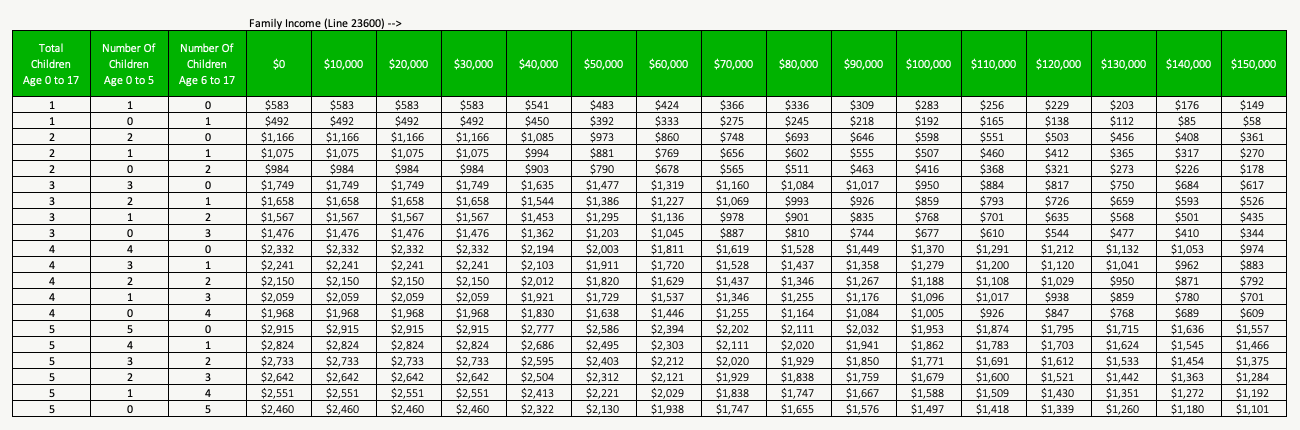

Canada Child Benefit Ccb Payment Dates For 2022 How Much Can You Get

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Issues With Child Tax Credit Direct Deposit How To Fix It By Aug 2 Cnet

Stimulus Checks Some States Are Issuing Checks And Bonuses To Millions Of Residents Cbs News

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Apply For Child Benefits And Use Child Tax Credits When Filing An Income Tax Return Canadian Immigrant

New Baby In 2021 Am I Eligible For Child Tax Credit

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

How To Change Your Address For Monthly Child Tax Credit Payments Kiplinger

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Issues With Child Tax Credit Direct Deposit How To Fix It By Aug 2 Cnet

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Is It Too Late To Claim The R D Tax Credit In 2021 Leyton Blog

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy